The value of sustainability

As the property market becomes increasingly competitive, there is a need to differentiate through better building performance. Andy Lewry, James Fisher and Matt Holden discuss how sustainability results in high performance buildings.

The management of real estate investments is aimed at maximising property value and return on investment. In the current highly competitive market place the challenges for real estate clients are:

• Increasing profit

• Maintaining competitive edge

• Driving asset yield

• Minimising voids

• ‘Being the best on the street’

• High productivity workspaces

A barrier to change is split responsibilities within the real estate sector but traditional positions are now being challenged.

Valuers are changing their position from paying a premium for green buildings to discounting because the building is not performing well.

|

|

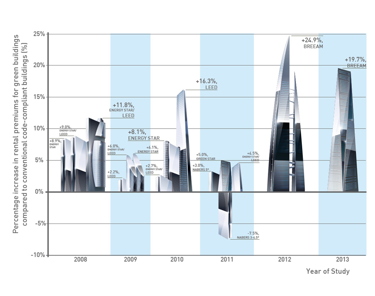

Figure 1. Studies on the rentable value for green buildings – reproduced from ‘Business case for green building’, World Green Building Council report, 2013. |

High-performing buildings provide a solution in that they have been shown to generate maximum profit via:

• Asset protection

• High and continuous rental income

• Low operating & maintenance cost

• Low depreciation issues

This is supported by the increase in rentable value shown by studies to be a maximum of 25% with an average of between 5-10% (see Figure 1).

Early engagement

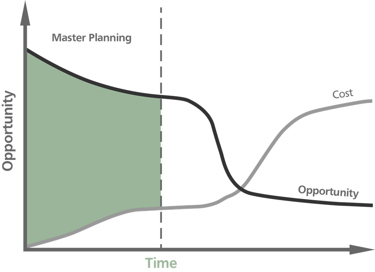

The earlier clients engage with sustainable design principles the more chance you have to influence the sustainability of the project at a lower cost (see Figure 2).

At the planning and pre-design stages there are opportunities through economies of scale, site-wide solutions and greater flexibility in design or decisions to be made.

Realising the benefits

The benefits of high performance buildings can be realised by the use of certification, such as one of the types of BREEAM.

As a process it facilitates:

• Client engagement

• Communication within project team and between developers and their clients

• Common language: standards, methods and data flows

Third party certification also offers:

• Assurance for clients, investors & other stakeholders;

• Comparability across building types and countries;

• Based on sound science and standards;

• One step ahead of legislation and industry best practices.

However, the operational phase of a building has an enormous impact on long-term performance. Around 80% of the lifetime costs of a building are embedded in the operational phase. What’s more non-domestic buildings have a design lifetime of 20 to 40 years. In the UK, newbuild commercial properties are only 1% per annum of the total available, so the majority of stock is in the operational phase, with its associated costs.

|

|

Figure 2. The window of opportunity for high performance design |

Poor operational management has a negative impact on the value of a property, and is also likely to create other issues including:

• Increased tenant complaints regarding comfort conditions and loss of reputation;

• Higher service charges

• Longer void periods (when the property or parts of it are not leased) leading to a reduction of income

• Lower and shorter rental values, because of higher service charges and poor comfort conditions

• Expenditure on heating, ventilation and air conditioning (HVAC) equipment failures, due to poor maintenance

• Tenants renegotiating rent values based on maintenance issues.

With these issues in mind, it’s useful to consider certification such as BREEAM in Use (BiU) or the Non-domestic Refurbishment and Fit-Out BREEAM standard (RFO). Sustainable certification has been shown to have many benefits for existing buildings:11% reduction on operatingcosts; an average 13% emissionreduction; and a cut of 15% onenergy costs.

Conclusion

A growing body of evidence demonstrates that sustainable commercial buildings that are well operated offer better return on investment for owners and landlords. What’s more, there is now a clear shift towards the attitude that sustainable and energy efficient buildings are the ‘norm’, particularly in the premium office market. Buildings that don’t offer these characteristics can expect lower rents (known as the ‘brown discount’), especially in the London office market.

Third party certification offers a common language for clients, designers and building occupants. It enables the construction team and end-users to understand what outcomes to expect from the design process. Certification is also helpful for existing buildings, offering a focus for refurbishments with sustainable and energy efficient outcomes, providing benefits for all.

Dr Andy Lewry and James Fisher are principle consultants at BRE; Matt Holden is economics consultant.