Centre points - Insights into the data centre market

Karen Fletcher considers the UK data centre market and highlights some key areas for consideration in terms of technology, design and building services in these challenging environments.

A data centre consists of a group of networked computer servers, used by organisations for remote storage, processing or distribution of large amounts of data. To those in the building services sector, ‘data centre’ also refers to the building that houses this technology.

Some data centres may be owned and managed by a single company. For example, Apple and Facebook construct and operate their own centres. However, colocation is a popular option for businesses looking to store data outside of their own physical offices. They rent shared space in a data centre, supplying their own servers, but the building owner/manager provides vital cooling, security and internet connection.

Even though IT hardware has gone through a process of ‘miniaturisation’, and desktop or laptop computers are enormously powerful compared to those of 30 years ago, we still require large-scale spaces to house the equipment that holds and manipulates data because now there is so much more of it. And as an increasing number of businesses are moving to ‘cloudbased’ systems where business information in digital format is held off-site, there seems no end in sight for the growth of data centres around the world.

Data centre customers include governments, banks and other financial service providers, as well as retailers and scientific research bodies. Businesses of all sizes use cloud-based services, so may not even be aware that they are indirect users of data centre services.

A growing market

The global data centre construction market is set to grow by around 8% by 2021 according to market specialists Technavio. The UK is the world’s second most popular data centre location after the USA. In 2017, Google, Microsoft and IBM all opened data centres in the UK.

We are regarded as an important IT hub offering well qualified personnel and good locations. Property consultants Bidwells highlight three key areas for data centre location in the UK. London is the most popular area because it is easy to find qualified staff and offers excellent transport links.

However, the regions are attracting more interest because they can offer more space – with the possibility of including on-site renewable power generation which is useful in the face of rising energy costs. Manchester is now a technology hub and has been boosted by government grants for technology start-ups. Berkshire is also pinpointed as a popular data centre location. Not only is it relatively close to London, there are also a number of business parks in the area.

|

|

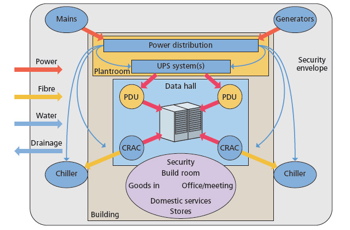

PDU (power distrubution unit); CRAC (computer room air conditioning) |

It is not only new-build data centres that offer an opportunity for building services. IT-specialist magazine Computer Weekly surveyed professionals in the data centre market early in 2018, and 29% of respondents stated that they were looking to upgrade their data centre infrastructure for a mix of efficiency, performance and technology-based reasons. These updates included cooling systems and power supplies. Making the most of the footprint of existing data centres is very much at the front of mind for data centre owners this year.

A demanding environment

The performance of data centre buildings allows for little tolerance of failure. Building services must operate within tight parameters.

The CIBSE publication ‘Data centres: An introduction to concepts and design’ (CIBSE Knowledge Series) highlights key issues that designers must consider: “Most computer equipment requires an environment with specific ranges of temperature, humidity and cleanliness requirements. High-quality power must be delivered to the equipment within acceptable ranges of voltage and frequency transients. The criticality of the information being processed requires the facility to be physically secure and therefore generally incorporates surveillance and access control.”

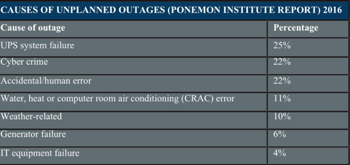

The diagram (reproduced with kind permission of CIBSE) shows in broad terms the main components of a data centre. Resilience and robust performance are vital for these buildings. A 2016 report by the Ponemon Institute estimated the cost of downtime at around $11,000 per minute for e-commerce companies, for example. Downtime costs are rising as more organisations rely on data centres. In general, building services equipment is robust. The report cites the failure of uninterruptible power supplies (UPS) as the number one reason for data centre downtime (25%), but this is closely followed by human error and cyber crime, which has grown rapidly as a source of concern in the last year.

Keep cool

Apart from operation of the data servers themselves, cooling is one of the most important functions within a data centre. The nature of the technology used in these buildings is such that it produces large amounts of heat, but its performance deteriorates quickly if allowed to overheat. CIBSE estimates that hot air stream temperatures can be expected to be ‘in the range of 50oC and higher.

The benefit of the high internal temperatures of data centres is that it is possible to make use of free cooling during most of the year in a climate such as the UK. This is becoming a more viable option as server technology moves on and a growing number of data centre service providers are designing their IT so that it can run in temperatures as high as 27oC.

However, it is important to note that while free cooling offers a low-energy solution, incoming air must be well filtered, and any openings to allow introduction of air must meet the facility’s security requirements.

In fact, a growing number of data centre owners and users are looking to ‘green’ their operations. While there is an element of corporate social responsibility driving this movement, energy costs are also a great incentive.

|

Energy has become the largest single element in the costs of ownership for a data centre, ranging from 20% to 60% of the facility’s costs (depending on building design and business model). These high numbers mean that rises in the price of energy can have a massive impact on the entire business.

As well as changing server technology to be less sensitive to high temperatures, companies such as Apple, Google and Facebook are looking to power their data sites using renewables such as wind energy.

However, this approach is not available to data centres which may be based in areas where space is at a premium.

Power usage in data centres has reached almost legendary levels, with some estimates now at 140 billion kWh by 2020 – although some IT experts dispute these figures on the grounds that technology is becoming more energy efficient. However, local government in the UK is increasingly insistent that new data centres demonstrate good energy efficiency and ‘green’ credentials.

Overall, the data centre market in the UK for new-build and refurbishment looks to be healthy over the next few years. Building services professionals can bring their specialist knowledge of cooling, energy efficiency, power management and renewables to bear on these challenging projects, and offer end-users real solutions for dealing with rising energy costs and planning requirements.

‘Data centres: An introduction to concepts and design’ is available from CIBSE publications at the link below.